hard money lenders in Atlanta Georgia Specializing in Fix & Flip

hard money lenders in Atlanta Georgia Specializing in Fix & Flip

Blog Article

Exploring the Advantages and Threats Related To a Hard Money Funding

Navigating the complex globe of actual estate financing, capitalists often run into the option of a Hard Money Loan. The key lies in understanding these facets, to make a notified decision on whether a Hard Money Funding matches one's financial strategy and threat resistance.

Comprehending the Basics of a Hard Money Loan

What specifically is a Hard Money Lending? Unlike standard financial institution car loans, difficult Money car loans are based primarily on the worth of the residential property being acquired, instead than the borrower's debt rating. These car loans are normally made use of for financial investment objectives, such as house flipping or development tasks, instead than individual, domestic use.

Secret Benefits of Opting for Hard Money Loans

Possible Risks and Drawbacks of Tough Money Fundings

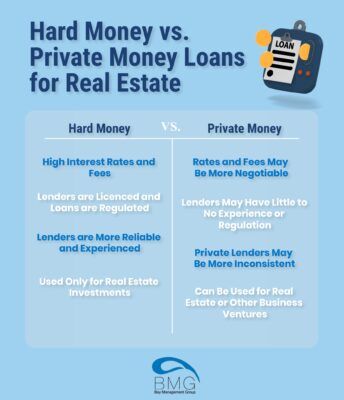

Regardless of the attractive benefits, there are some substantial risks and drawbacks associated with hard Money lendings. These fundings often include high rates of interest, sometimes dual that of typical car loans. This can cause monetary stress otherwise taken care of appropriately. Moreover, hard Money loans normally have much shorter repayment periods, usually around year, which can be challenging for debtors to meet. Additionally, these financings are usually protected by the debtor's building. If the customer is not able to repay the Lending, they risk shedding their building to repossession. Last but not go least, tough Money loan providers are less managed than standard loan providers, which may reveal consumers to dishonest financing practices. For this reason, while difficult Money lendings can offer quick financing, they additionally lug considerable dangers. hard money lenders in atlanta georgia.

Case Situations: When to Take Into Consideration a Hard Money Lending

Comparing Difficult Money Car Loans With Various Other Financing Options

Just how do hard Money lendings pile up versus various other funding options? When compared to standard car loans, difficult Money finances provide a quicker authorization and funding procedure because of fewer regulations and requirements. Nevertheless, they usually include greater rates of interest and costs. In comparison, small business loan supply reduced rates of interest however have rigid qualification criteria and a slower authorization time. Private my link car loans, on the other hand, offer adaptability in terms however might do not have the structure and protection of tough Money lendings. Finally, crowdfunding and peer-to-peer financing systems provide a distinct alternative, with affordable rates and simplicity of access, but might not be ideal for bigger funding needs. The choice of funding depends on the customer's certain requirements and situations.

Conclusion

In weblink final thought, hard Money loans use a practical remedy for genuine estate investors requiring swift and flexible financing, specifically those with debt challenges. The high interest prices and much shorter repayment timeframes require mindful consideration of prospective threats, such as foreclosure. It's vital that consumers thoroughly review their economic strategy and risk resistance prior to choosing this sort of Funding, and compare it with various other funding alternatives.

Unlike typical financial institution lendings, tough Money lendings are based mainly on the value of the home being acquired, rather than the consumer's credit report score. These loans usually come with high rate of interest rates, sometimes dual that of typical loans. In scenarios where a consumer desires to prevent a prolonged Funding process, the extra uncomplicated tough Money Lending application can provide a more hassle-free option.

When compared with standard car loans, hard Money car loans provide a quicker approval and financing process due to less needs and regulations - hard money lenders in atlanta georgia. Personal car loans, on the other hand, deal versatility in terms but might do not have the framework and safety and security of tough Money loans

Report this page